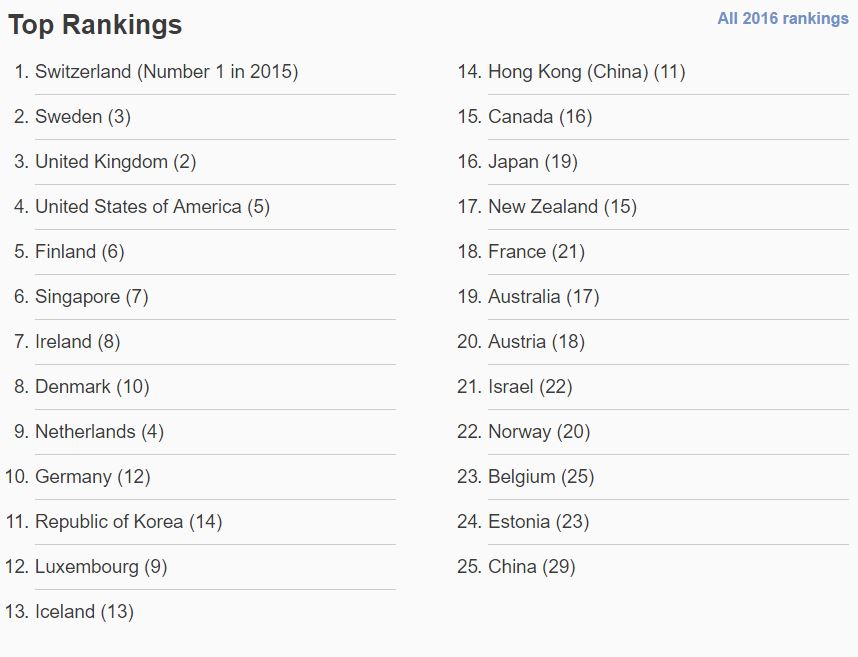

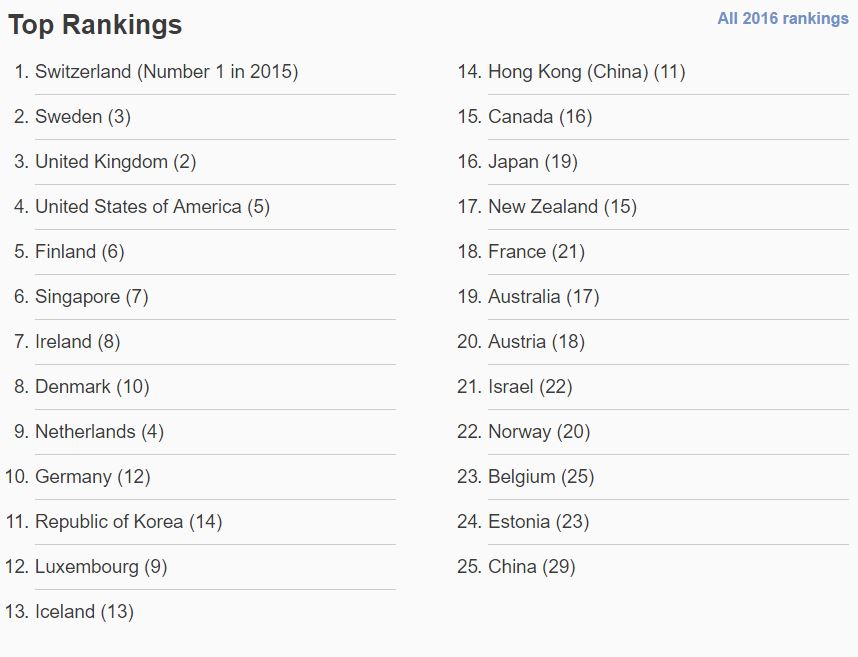

China’s top-25 entry marks the first time a middle-income country has joined the highly developed economies that have historically dominated the top of the Global Innovation Index (GII) throughout its nine years of surveying the innovative capacity of 100-plus countries across the globe. China’s progression reflects the country’s improved innovation performance as well as methodological considerations such as improved innovation metrics in the GII.

Despite China’s rise, an “innovation divide” persists between developed and developing countries amid increasing awareness among policymakers that fostering innovation is crucial to a vibrant, competitive economy.

Innovation requires continuous investment. Before the 2009 crisis, research and development (R&D) expenditure grew at an annual pace of approximately 7%. GII 2016 data indicate that global R&D grew by only 4% in 2014. This was a result of slower growth in emerging economies and tighter R&D budgets in high-income economies – this remains a source of concern.

“Investing in innovation is critical to raising long-term economic growth,” says WIPO Director GeneralFrancis Gurry. “In this current economic climate, uncovering new sources of growth and leveraging the opportunities raised by global innovation are priorities for all stakeholders.”

Among the GII 2016 leaders, four economies — Japan, the U.S., the UK, and Germany— stand out in “innovation quality,” a top-level indicator that looks at the caliber of universities, number of scientific publications and international patent filings. China moves to 17th place in innovation quality, making it the leader among middle-income economies for this indicator, followed by India which has overtaken Brazil.

Soumitra Dutta, Dean, Cornell College of Business, and co-editor of the report, points out: “Investing in improving innovation quality is essential for closing the innovation divide. While institutions create an essential supportive framework for doing so, economies need to focus on reforming education and growing their research capabilities to compete successfully in a rapidly changing globalized world.”

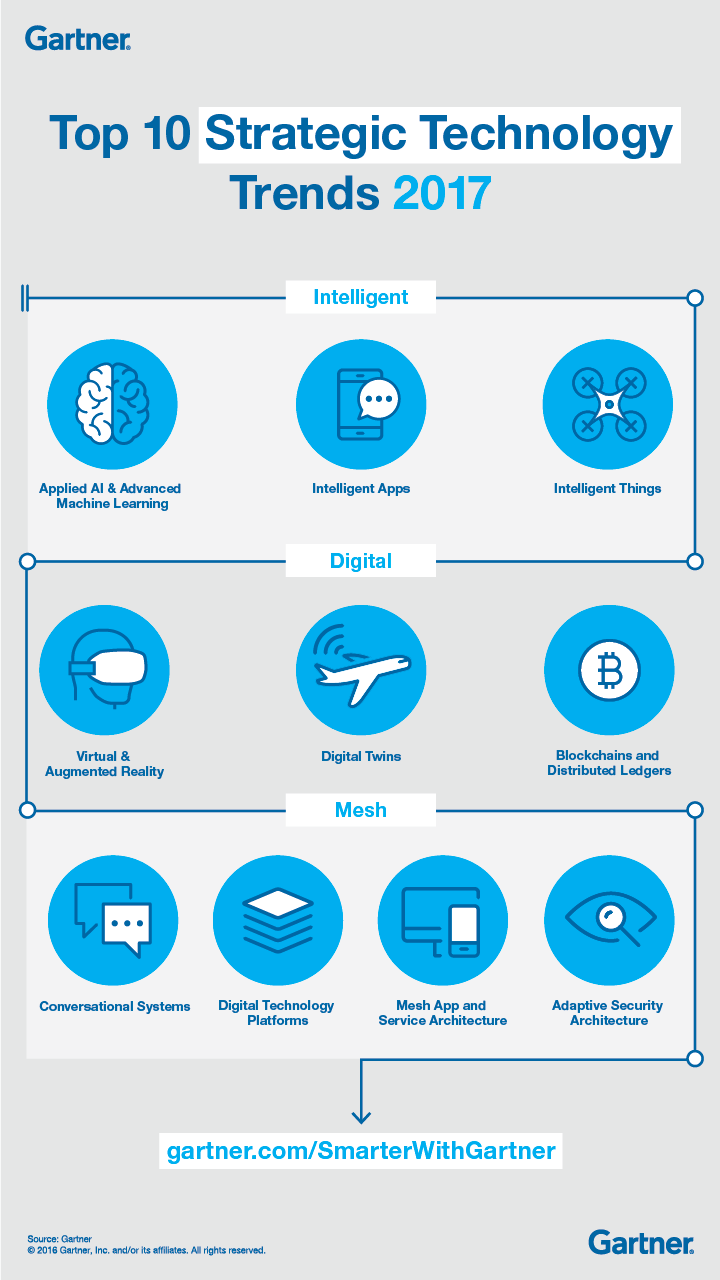

GII 2016 Theme: “Winning with Global Innovation”

The GII theme this year is “Winning with Global Innovation.” The report explores the rising share of innovation carried out via globalized innovation networks, finding that gains from global innovation can be shared more widely as cross-border flows of knowledge and talent are on the rise. The report also concludes that there is ample scope to expand global corporate and public R&D cooperation to foster future economic growth.

Bruno Lanvin, INSEAD Executive Director for Global Indices, and co-author of the report, underlines: “Some may see globalization as a trend in search of its ‘second breath.’ Yet, the relative contraction of international trade and investment flows does give even more strategic importance to the two sides of global innovation: on one hand, more emerging countries are becoming successful innovators, and on the other hand, an increasing share of innovation benefits stem from cross-border co-operation.”

At the national level, the report says that innovation policies should more explicitly favor international collaboration and the diffusion of knowledge across borders. New international governance structures should also aim to increase technology diffusion to and among developing countries.

Johan Aurik, Managing Partner and Chairman of GII Knowledge Partner A.T. Kearney, the global consultancy, says: “Digital has become a primary driver of strategy development and innovation for business in almost all sectors; I am convinced we are only at the beginning. Notably for established organizations, the challenge lies in finding ways to successfully innovate by using and transforming existing resources and business practices. Realizing success in today’s new landscape requires creative, forward-thinking strategies that embrace digital and address the need to change the fundamental ways of working in the company.”

Northern America

The U.S. (4th) continues to be one of the world’s most-innovative nations, with particular strengths including the presence of firms conducting global R&D, the sophistication of its financial market, including venture capital, the quality of its universities and scientific publications, software spending, and the state of its innovation clusters. The U.S. scores lower, however, in expenditures on education, in tertiary education due to its low share of graduates in science and engineering, in energy efficiency, and in economy-wide investment and productivity critical to future growth.

Canada (15th overall in the GII) has top scores in its regulatory environment, the ease of starting a business, the sophistication of its financial market, including venture capital, the quality of its universities and scientific publications, as well as in online creativity. Yet, Canada’s GII rankings had declined in previous years, with its fall from the top 10 due largely to methodological changes as well as comparatively weak performance in education and R&D expenditures, information and communication technology (ICT) services, energy efficiency, and, similarly to the U.S., in economy-wide investment and productivity figures.

Sub-Saharan Africa

Mauritius takes the top spot among all economies in the region (53rd), followed by South Africa (54th), Kenya (80th), Rwanda (83rd), Mozambique (84th), Botswana (90th), Namibia (93rd), and Malawi (98th).

Since 2012, Sub-Saharan Africa has counted more countries than any other region among the group of “innovation achievers” – countries that perform better than their level of development would predict. This year, Kenya, Madagascar, Malawi, Mozambique, Rwanda, and Uganda stand out. Better rankings on the indicators for institutions, business sophistication, and knowledge and technology output have allowed the region to catch up to Central and Southern Asia, and to overtake Northern Africa and Western Asia.

Average regional performance shows strengths in the ease of starting a business, ICTs, business-model creation, and relative expenditure on education, with weaknesses in firms conducting global R&D, high-tech exports, the quality of local universities and number of scientific publications. In general, further efforts are required in Human capital, Research and Infrastructure.

As economic growth in Sub-Saharan Africa is slowing, the GII 2016 shows that Sub-Saharan Africa must preserve its current innovation momentum, while continuing to diversify economies away from oil production and commodity revenues.

Latin America and the Caribbean

Chile takes the top spot among all economies in the region (44th) driven by good scores on the indicators for institutions, infrastructure and business sophistication, followed by Costa Rica (45th), Mexico (61st), Uruguay (62nd), and Colombia (63rd). Brazil is ranked 69th, with strengths in relevant education and R&D factors, the quality of its scientific publications, and high-tech manufacturing; yet relative weaknesses in its business environment (123rd), elements of tertiary education (111th) and, more generally, its ability to generate innovation outputs, and the creation of new businesses.

Latin America is a region with important untapped innovation potential. The GII rankings of local economies have not significantly improved relative to other regions in recent years, and no country in the region currently shows a performance higher than its GDP.

The report suggests that, as Latin America, and especially Brazil, have entered into a zone of economic turbulence, it is important to overcome short-term political and economic constraints and to redouble longer-term innovation commitments. Greater regional R&D and innovation cooperation can help the region in this process, as underlined in this year’s GII theme.

Central and Southern Asia

India, 66th, is the top-ranked economy in Central and Southern Asia, showing particular strengths in tertiary education and R&D, including global R&D intensive firms, the quality of its universities and scientific publications, its market sophistication and ICT service exports where it ranks first in the world. India also over-performs in innovation relative to its GDP. It ranks second on innovation quality amongst middle-income economies, overtaking Brazil. Relative weaknesses exist in the indicators for business environment, education expenditures, new business creations and the creative goods and services production.

“The commitment of India to innovation and improved innovation metrics is strong and growing, helping to improve the innovation environment. This trend will help gradually lift India closer to other top-ranked innovation economies”, says Chandrajit Banerjee, Director General of Confederation of Indian Industry (CII). Following India in the region are Kazakhstan (75th), the Islamic Republic of Iran (78th), Tajikistan (86th), Sri Lanka (91st), and Bhutan (96th).

Northern Africa and Western Asia

Of the top five GII performers in this region, two are from the six-member Gulf Cooperation Council (GCC): United Arab Emirates (41st) and the Kingdom of Saudi Arabia (49th). Many of the GCC countries are diversifying their economies following a decades-long dependence on oil, turning their focus towards more innovation-driven and diverse sources of growth and overcoming relative shortcomings in areas, such as Institutions, market and business sophistication.

“Innovation no longer occurs in silos, today it crosses borders and relies on collaboration between various entities to create a win-win prospect. The UAE is harnessing a globalized strategy to lead innovation internationally through its Smart City agenda and bring about a greater degree of convenience and satisfaction, and ultimately happiness, for all,” says Osman Sultan, Chief Executive Officer, du.

Israel (21st) – consistently the only economy among the overall top 25 GII rankings and in the top 10 for any GII pillar — and Cyprus (31st) are the top two nations in the region for the fourth consecutive year. Turkey ranks 4th in the region in 2016 and 42nd overall. Armenia (60th) is the only economy in the region which outperforms relative to its GDP.

The region shows its highest average scores in ICT access and ICT-driven business model creation, as well as in e-government, and productivity growth. Less notable performances are seen in high-tech exports, patents, and the quality of publications.

South East Asia, East Asia, and Oceania

Singapore (6th), the Republic of Korea (11th), Hong Kong (China) (14th), Japan (16th), and New Zealand (17th) lead the rankings in this region. The majority of innovation leaders in the GII are in this region or Europe.

Among upper-middle-income economies, China (25th), Malaysia (35th), and Thailand (52nd) rank first in the region. Viet Nam (59th) maintains its top place among lower-middle-income economies, followed by the Philippines (74th,) and Indonesia (88th). Low-income economy Cambodia maintains its ranking in the top 100 economies overall (95th).

The region’s strongest average performance is in the number of teachers per pupils and productivity growth, with lower scores in R&D financed by foreign firms, ICT services exports and imports, and intellectual property receipts.

Europe

Fifteen of the top 25 economies in the GII come from Europe, including the top three. Switzerland retains the top position for the sixth consecutive year, followed by Sweden (2nd), and the United Kingdom (3rd). Following these top 3 regional leaders are Finland (5th), Ireland (7th), Denmark (8th), the Netherlands (9th), and Germany (10th), which joins the top 10 in 2016.

Europe benefits from comparatively strong institutions and well-developed infrastructure, while room for improvement is found in business sophistication and knowledge and technology outputs. Europe does particularly well in environmental performance, ICT access, and school life expectancy. At the same time, there is room for improvement in R&D financed by businesses, R&D financed by foreign firms, high-tech exports, and international patent filings.

Source: http://www.wipo.int/pressroom/en/articles/2016/article_0008.html

read more